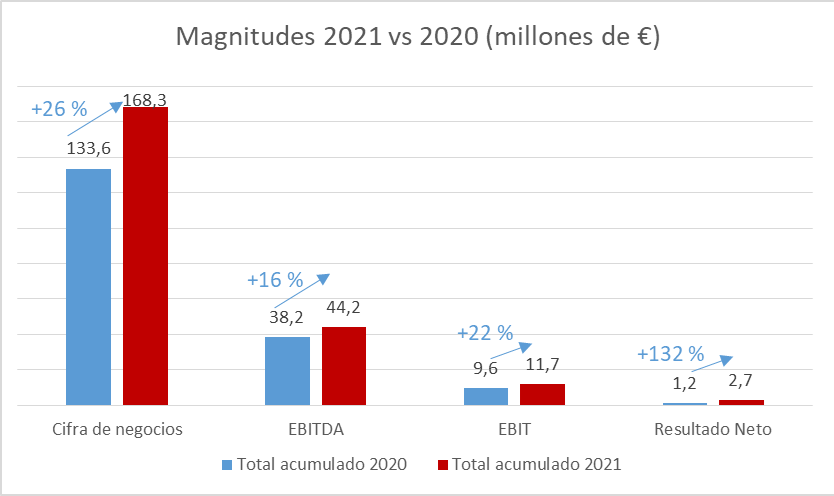

Sales reach €168.3 million, with increases across all business lines, while EBITDA closes at €44.2 million and exceeds pre-pandemic levels

The company reports a profit of €2.7 million (+132% over 2020)

GAM has presented the results for 2021, overcoming the difficulties caused by the COVID-19 pandemic and consolidating profitable double-digit growth in all its businesses.During the 2021 fiscal year, revenue increased by 26% to €168.3 million. The EBITDA margin reached €44.2 million, growing by 16%, and represents 26% of sales, already surpassing pre-pandemic levels. Meanwhile, GAM’s profit increased by 132% to €2.7 million.

All business lines grew in double digits. For instance, revenue from recurring services grew by 36% to €32.4 million. The contracted portfolio, with average periods of four years, increased by 63%, with an additional €53 million contracted in 2021 for these types of services.

Businesses without Capex (those not requiring additional investment, such as Distribution, Training, Maintenance, or Buying and Selling) grew by 42% to €62.9 million. The higher weight of these non-Capex businesses led to a 22% increase in EBIT and a doubling of profit.

The company overcame the challenges posed by the pandemic throughout the year. In addition to activity restrictions, which primarily affected the first part of the previous year, delays in machinery delivery from manufacturers due to supply chain issues were also encountered.

Despite this, in the second half of the year, GAM’s figures significantly surpassed those of the first semester. In the second half, sales reached €90.9 million, with an EBITDA of €26.1 million (29% of sales), far exceeding pre-pandemic figures for the same period in 2019. The profit for the second half of the year thus reached €3.5 million.

Delays in delivery times from manufacturers -averaging around five months- have resulted in a significant portion of the investments (Capex) occurring in the latter part of the year, slowing growth and causing a lag between the investment entry and the generation of results and cash flow associated with them. The company, anticipating these delays and price increases due to inflationary pressures, has doubled its stocks.

During 2021, GAM continued with its inorganic growth strategy with the acquisitions of Recamasa and the load movement business of Ascendum in Portugal. This was followed by the acquisition of Grupo Dynamo Hispaman (GDH) in January 2022. With these operations, the company has strengthened its position in recurring businesses, Maintenance, and Distribution in Iberia, becoming the main dealer for Hyster-Yale brands.

The investments made during the year include, in addition to the aforementioned acquisitions totaling €13.5 million, other resources allocated to GAM’s Sustainability Plan amounting to an additional €9 million: for the development of sustainable mobility projects through the subsidiary INQUIETO, which provides solutions for last-mile logistics; for the electrification of the machinery fleet, where 75% of rental units are already zero-emission equipment; for the development of a machinery remanufacturing plant; as well as for other digitization projects.

The company maintains a strong liquidity position that will allow it to continue seizing growth opportunities.